So, we now need to separate that payment into its interest and principal components. (Note that your actual mortgage payment would be higher because it would likely include insurance and property tax payments that would be funneled into an escrow account by the mortgage service company.) You should find that the monthly payment is $1,297.196. Now, to calculate the monthly payment, scroll down to the PMT row and then press ALPHA ENTER. The same trick works for I%, which in this case will be converted to 0.5625%. So, when you type 30*12 for N and then press the down arrow key, the value for N will automatically be converted to 360. Note that when you use the arrow keys to move away from any of the items, the calculator will automatically perform any calculations in that row. Enter the data exactly as shown below: Field This can be done within the TVM Solver itself. Note that since we are making monthly payments, we will need to adjust the number of periods (N) and the interest rate (I%) to monthly values. So, enter the TVM Solver by pressing the APPS button and then choose the first item in the Finance Menu. We can do this most easily by using the TVM Solver. Our first priority is to calculate the monthly payment amount. What will be the monthly payment? How much of the first payment will be interest, and how much will be principal? The terms of the loan specify an initial principal balance (the amount borrowed) of $200,000 and an APR of 6.75%. Imagine that you are about to take out a 30-year fixed-rate mortgage. Let's start by reviewing the basics with an example loan (if you already know the basics, you can skip right to Creating an Amortization Schedule): Calculating Interest and Principal in a Single Payment

Typically, it will also show the remaining balance after each payment has been made. It is the presence of the principal payment that slowly reduces the loan balance, eventually to $0.Īn amortization schedule is a table that shows each loan payment and a breakdown of the amount of interest and principal paid. Each payment in this type of loan consists of interest and principal payments. The loan balance is fully retired after the last payment is made. Typically, but not always, a fully amortizing loan is one that calls for equal payments ( annuity) throughout the life of the loan. Examples include home mortgages, car loans, etc. If you prefer to use a spreadsheet, which I do, please see my spreadsheet amortization tutorial.įully amortizing loans are quite common.

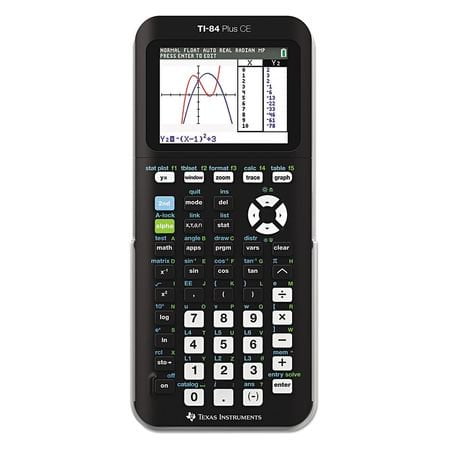

We will use this functionality to generate a complete amortization table. One of the advantages of these calculators over other financial calculators is their ability to create tables of data.

#TEXAS INSTRUMENTS TI 84 ONLINE USE HOW TO#

In this tutorial we will see how to create an amortization schedule for a fixed-rate loan using the TI 83, 83 Plus, or TI 84 Plus graphing calculators from Texas Instruments.

#TEXAS INSTRUMENTS TI 84 ONLINE USE FREE#

Are you a student? Did you know that Amazon is offering 6 months of Amazon Prime - free two-day shipping, free movies, and other benefits - to students? Click here to learn more

0 kommentar(er)

0 kommentar(er)